Reverse charging mechanism a procedural way of discharging tax liabilities and formalities by buyer of services or goods or both instead of seller.

Generally, the supplier of goods or services is liable to pay GST. However, in specified cases like imports and other notified supplies, the liability may be cast on the recipient under the reverse charge mechanism. Reverse charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply.

If you as a recipient of services or goods or both are liable to pay tax under reverse charge mechanism, you have to comply with all the provisions applicable under GST to a registered person.

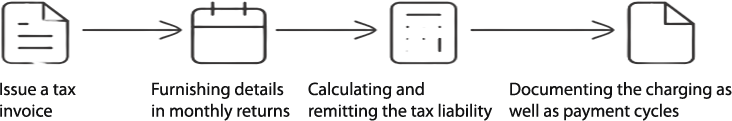

For example, following procedural as well as documentary functions are performed when a registered person makes a supply.

Above are the general functions that a registered person has to perform to comply with law. When you pay under RCM, it becomes your obligations to comply with these rules.

You must be aware that under GST tax liability arises of time of supply. So to find out the point at which you will be liable to charge tax on supplies received and fall under RCM, you first need to check the time of supply.

In case of RCM, the time of supply is earliest of:

If you are not able to find the time of supply as per above list then time of supply will the date on which you account the transaction in your books of accounts.

In case of services the time of supply should be earliest of:

In case of import of services from associated parties, the time of supply should be earliest of:

Before moving to accounting treatment and entries that should be posted lets understand some basic points.

Considering above points, we suggest to have a separate accounting ledger specifically for tax paid under Reverse Charge and should not be clubbed with normal tax ledgers.